Goldman Sachs explains why you should ‘buy’ these 2 cybersecurity stocks

Our electronic environment operates on pc tech, and that tech is only going to turn into much more autonomous and more ubiquitous. And that, in switch, only underscores the ongoing worth of online security. With electronic automation developing, it is more critical than ever, right now, to start out firming up the digital protections.

Versus this backdrop, Goldman Sachs’ Gabriela Borges has turned her eye on the cybersecurity sector. The analyst sees numerous market dynamics that are favorable for very long-phrase buyers, including: “(1) Multi-product or service platforms have obtained momentum and are nearer to solving the challenge of remaining ground breaking in subsegments historically outlined by boom and bust product or service cycles. (2) The business is fewer cyclical as mix shifts away from components and towards SaaS, and offered constant prioritization of protection expend in business budgets.”

Borges does not go away us with a macro watch of the industry. The analyst goes on to give a drill-down to the micro degree, and picks out two cybersecurity shares that she sees as probable winners for the very long haul.

In simple fact, Borges is not the only just one singing these stocks’ praises. According to the TipRanks platform, each individual offers a “Strong Buy” consensus rating from the broader analyst community, and provides double-digit upside potential for the calendar year forward. Let us just take a nearer seem.

CrowdStrike Holdings (CRWD)

The initially Goldman-select we’ll glance at is CrowdStrike, the producer of the higher-conclude Falcon Endpoint Security line, and a chief in the cybersecurity ecosystem. CrowdStrike’s merchandise have set an industry regular for on line network defense and for digital safety, and consist of a selection of cloud-based mostly modules for a wide assortment of applications. The firm can make the goods available by membership by the Software program-as-a-Support model.

The corporation noted some seem metrics in its final quarterly report, for Q3 of fiscal 2023. Income was up 53{b7c9e2c88beb1a84f22d94ab877a147f4adc4b3519717f3f957a0f34e16918d1} 12 months-about-yr, at $581 million, and yearly recurring earnings, at $2.34 billion, was up 54{b7c9e2c88beb1a84f22d94ab877a147f4adc4b3519717f3f957a0f34e16918d1}. On the base line, CrowdStrike reported a fiscal Q3 earnings of 40 cents per share, by non-GAAP steps, beating consensus estimate of 32 cents for every share.

However, the business furnished revenue steerage that fell limited of estimates. Especially, Q4 income is expected to be in a range of $619.1 million to $628.2 million, underneath Road estimates of $634.2 million.

Although acknowledging that existing current market disorders act as a headwind on the inventory, Goldman Sachs’ Gabriela Borges believes it is very well-put for robust expansion.

“We hope to see a moderation in development rate… driven largely by slower advancement in the endpoint TAM and a slower rate of sector share obtain – and we consider this is perfectly comprehended by the marketplace. Over the medium phrase, 1) we hope to see constant advancement in endpoint (80{b7c9e2c88beb1a84f22d94ab877a147f4adc4b3519717f3f957a0f34e16918d1}+ of ARR), primarily based on our base-up industry share model suggesting subsequent-gen endpoint systems hold close to 50{b7c9e2c88beb1a84f22d94ab877a147f4adc4b3519717f3f957a0f34e16918d1} share nowadays 2) we expect to see outsized development in cloud, exactly where our market discussions counsel CrowdStrike is aggressive offered its main competencies in info assortment and monitoring,” Borges opined.

“Taken alongside one another with solid FCF generation right now and a reset to quantities in 3Q23 (2023 Avenue revenue has been revised down 3{b7c9e2c88beb1a84f22d94ab877a147f4adc4b3519717f3f957a0f34e16918d1} around the final 3 months), we believe that danger/reward is interesting,” the analyst summed up.

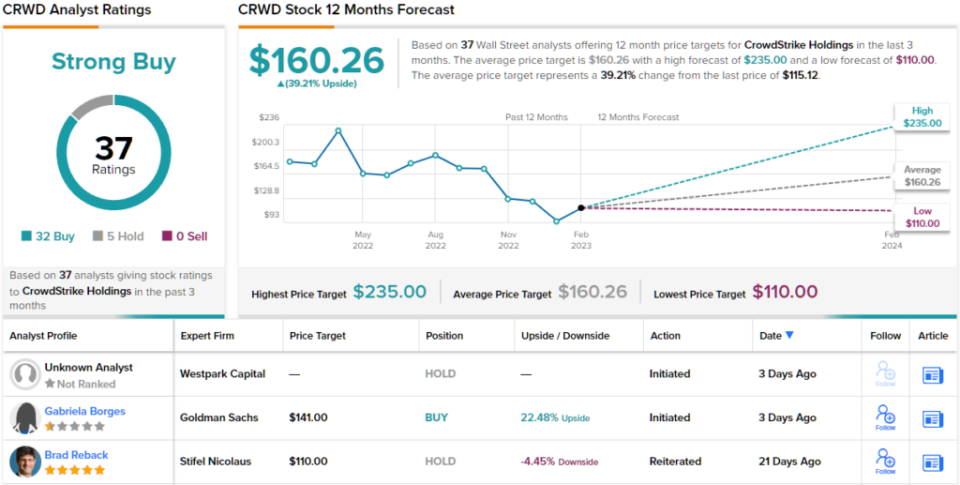

Over-all, Borges believes this is a inventory worthy of keeping on to. The analyst premiums CRWD shares a Acquire, and her $141 value focus on implies a 22{b7c9e2c88beb1a84f22d94ab877a147f4adc4b3519717f3f957a0f34e16918d1} upside in the next 12 months. (To view Borges’ monitor file, click on listed here)

Entirely, CrowdStrike has 37 recent analyst evaluations on file – these include things like 32 Purchases and just 5 Holds, for a Robust Buy consensus ranking. The shares are promoting for $115.12 and the common price tag concentrate on, now at $160.26, implies a 39{b7c9e2c88beb1a84f22d94ab877a147f4adc4b3519717f3f957a0f34e16918d1} a person-calendar year attain. (See CRWD stock forecast)

Palo Alto Networks (PANW)

The following stock on Goldman’s radar is Palo Alto Networks, another important title in electronic security. This company’s combination of firewall products and solutions and state-of-the-artwork cybertech gives consumers a substantial degree of protection for on-line techniques, such as defense versus malware assaults, and also allows automation of network and on the internet stability functions. Palo Alto also will make its enterprise-grade stability computer software accessible to residence and smaller small business end users looking to guard their network and cloud programs.

Over the past couple several years, Palo Alto has constructed a steadily expanding income stream based mostly on its merchandise line and marketplace-primary reputation. In the final claimed quarter, for fiscal 1Q23, the enterprise described $1.56 billion at the best line, dependent on $175 billion in whole billings. These figures represented yr-more than-12 months will increase of 25{b7c9e2c88beb1a84f22d94ab877a147f4adc4b3519717f3f957a0f34e16918d1} and 27{b7c9e2c88beb1a84f22d94ab877a147f4adc4b3519717f3f957a0f34e16918d1} respectively. The company’s backlog, a key indicator of foreseeable future operate and revenues stood at $8.3 billion as of Oct 31 last 12 months.

At the bottom line, Palo Alto posted an adjusted 83 cents per share, beating estimates of 69 cents per share. The firm finished its fiscal first quarter with a $1.2 billion in free of charge income movement, and almost $2.1 billion in funds on hand. We’ll see up coming 7 days, when Palo Alto stories earnings for fiscal Q2, how its performance is holding up.

In the meantime, Goldman’s Borges sees a distinct route ahead for the organization, and lays it out in effortless prose: “We watch Palo Alto as a portfolio of network, endpoint and cloud products at various phases of products maturity, each and every leveraging centralized domain knowledge in consumer interface/user encounter (UIUX), promoting, safety intelligence and machine mastering. Together with a thriving M&A strategy, we expect to see sturdy expansion of ~20{b7c9e2c88beb1a84f22d94ab877a147f4adc4b3519717f3f957a0f34e16918d1} for the subsequent 5 decades with best quartile software package KPIs, a route to GAAP profitability this calendar year, and energetic money allocation.”

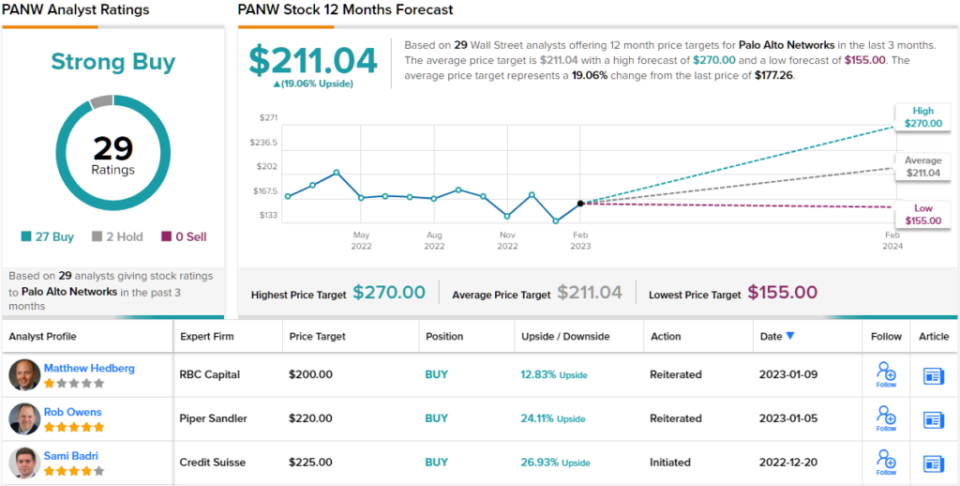

Tracking forward from below, Borges presents PANW shares a Get ranking, with a $205 just one-calendar year price focus on that implies a probable attain of 19{b7c9e2c88beb1a84f22d94ab877a147f4adc4b3519717f3f957a0f34e16918d1}.

The Solid Obtain consensus rating on this inventory demonstrates that the Road is clearly in-line with Goldman’s bullish look at of the 29 new analyst testimonials, 27 are to Obtain and only 2 to Hold. PANW shares have an typical price tag goal of $211.04, implying a 19{b7c9e2c88beb1a84f22d94ab877a147f4adc4b3519717f3f957a0f34e16918d1} upside from the trading price tag of $172.02. (See PANW stock forecast)

To discover superior ideas for stocks investing at interesting valuations, check out TipRanks’ Finest Shares to Purchase, a device that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this post are solely those of the featured analysts. The articles is supposed to be used for informational functions only. It is really crucial to do your very own investigation before making any investment.